- Gambling Losses Tax Deductible Canada

- Gambling Losses Tax Itemized Deductions

- Gambling Loss Tax Deduction

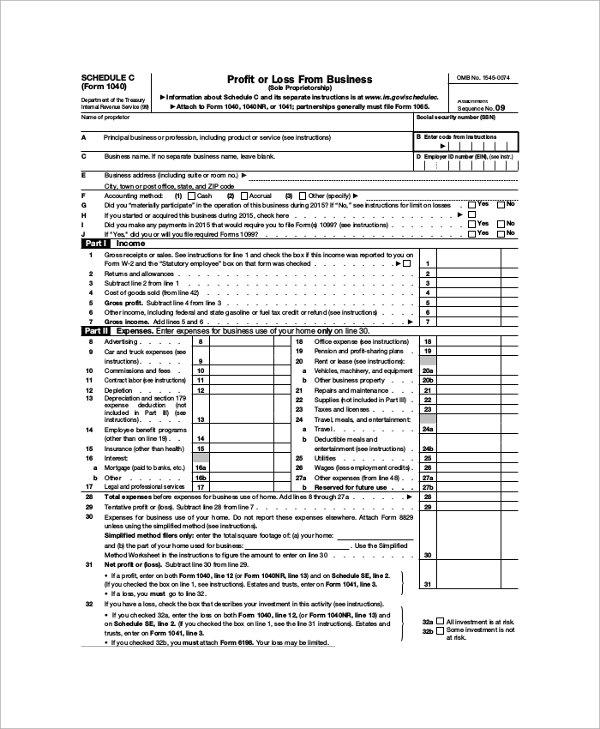

The IRS requires a mandatory 24% withholdings on winnings that exceed $5,000. Winnings and losses from gambling must be reported separately; do not deduct losses from winnings. Gambling losses can be deducted up to the amount of winnings, not more. 115–97, § 11050(a), inserted at end 'For purposes of the preceding sentence, in the case of taxable years beginning after December 31, 2017, and before January 1, 2026, the term ‘losses from wagering transactions' includes any deduction otherwise allowable under this chapter incurred in carrying on any wagering transaction.'. For example, if you won $3,000 from gambling for 2016, the most you can deduct on your 2016 tax return is $3,000, no matter how much you lost. Losses must be reported on Schedule A as an Itemized Deduction, which are separate from winnings. Continue reading for important facts about claiming your gambling losses on your tax return. Gambling losses only save taxes to the extent they exceed: the standard deduction less other itemized deductions. Gambling losses do not reduce Adjusted Gross Income (AGI). This can be a BIG problem. See The AGI Problem below. Gambling losses are exempt from the 2% AGI threshold that applies to some itemized deductions. Gambling losses are. If you lose money gambling, you might be able to deduct it on your tax returns. However, before you can claim the deduction, you'll have to meet two important requirements. First, the IRS will want you to itemize all of your deductions. Second, you can only deduct gambling losses to the extent that you have gambling winnings.

Gamblers understand the concept of win some, lose some. But the IRS? It prefers exact numbers. Specifically, your tax return should reflect your total year's gambling winnings – from the big blackjack score to the smaller fantasy football payout. That's because you're required to report each stroke of luck as taxable income — big or small, buddy or casino.

If you itemize your deductions, you can offset your winnings by writing off your gambling losses.

It may sound complicated, but TaxAct will walk you through the entire process, start to finish. That way, you leave nothing on the table.

How much can I deduct in gambling losses?

You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you're itemizing your deductions. If you're taking the standard deduction, you aren't eligible to deduct your gambling losses on your tax return, but you are still required to report all of your winnings.

Where do I file this on my tax forms?

Let's say you took two trips to Vegas this year. In Trip A, you won $6,000 in poker. In the Trip B, you lost $8,000. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won't owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000.

Now, let's flip those numbers. Say in Trip A, you won $8,000 in poker. In Trip B, you lost $6,000. You'll report the $8,000 win on your return, the $6,000 loss deduction on Schedule A, and still owe taxes on the remaining $2,000 of your winnings.

What's a W-2G? And should I have one?

A W-2G is an official withholding document; it's typically issued by a casino or other professional gaming organization. You may receive a W-2G onsite when your payout is issued. Or, you may receive one in the mail after the fact. Gaming centers must issue W-2Gs by January 31. When they send yours, they also shoot a copy to the IRS, so don't roll the dice: report those winnings as taxable income.

Don't expect to get a W-2G for the $6 you won playing the Judge Judy slot machine. Withholding documents are triggered by amount of win and type of game played.

Expect to receive a W-2G tax form if you won:

- $1,200 or more on slots or bingo

- $1,500 or more on keno

- $5,000 or more in poker

- $600 or more on other games, but only if the payout is at least 300 times your wager

Tip: Withholding only applies to your net winnings, which is your payout minus your initial wager.

Leo casino dock road liverpool england. The Grosvenor Casino Liverpool, known as the Leo Casino, offers a blend of traditional and state-of-the-art casino gaming. Gaming at the Leo Casino consists of electronic roulette and slots from just 10p. We also have blackjack and roulette games, Punto Banco, and a large poker room offering cash games. Leo's is the swankiest Casino in Liverpool. It's situated on the Dock Road and its roulette tables overlook the river Mersey. It looks elegant and fluorescent at night, lit up with big blue lights and looking like a venue that oozes money. Of course it does, it's a casino! Found just next to the world-famous Albert Docks, Grosvenor Casino Leo brings contemporary European dining to Liverpool. Both traditional and state-of-the-art games are on offer, as well as 2 cocktail bars and stunning panoramic river views.

What kinds of records should I keep?

What kinds of records should I keep?

Gambling Losses Tax Deductible Canada

Keep a journal with lists, including: each place you've gambled; the day and time; who was with you; and how much you bet, won, and lost. You should also keep receipts, payout slips, wagering tickets, bank withdrawal records, and statements of actual winnings. You may also write off travel expenses associated with loss, so hang on to airfare receipts.

Gambling Losses Tax Itemized Deductions

Use TaxAct to file your gambling wins and losses. We'll help you find every advantage you're owed – guaranteed.